If you’re like most small businesses, your cash flow is king. Tracking your cash flow is essential to ensuring that your business can stay afloat during tough times. Fortunately, there are a number of free and easy methods for tracking your cash flow.

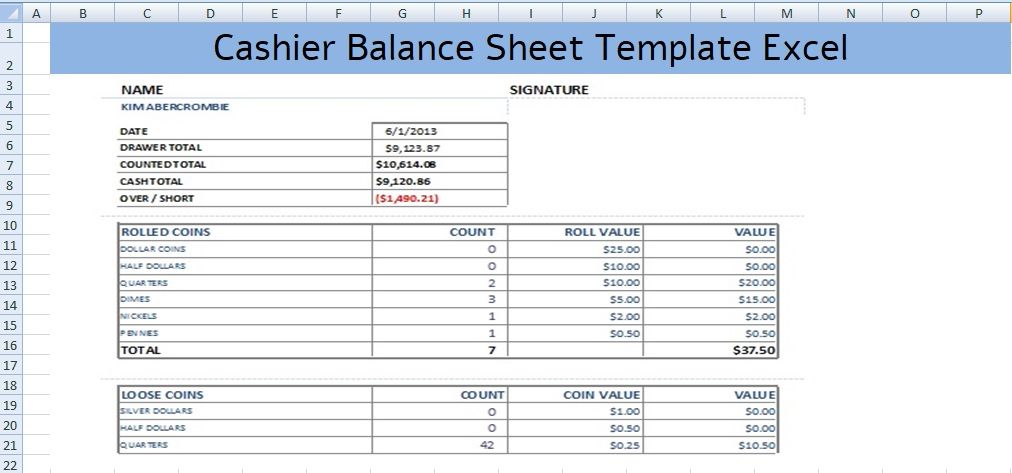

One of the simplest methods is to track your cash balance on a monthly or weekly basis using a spreadsheet. A cashier balance sheet template can be extremely helpful in organizing this information.

What is a Cashier Balance Sheet

A cashier’s balance sheet is a valuable financial tool used to track the performance of a business. It can help identify where money is being spent and where improvements may be needed.

The balance sheet should be created annually and reviewed regularly to ensure its accuracy. There are a few key elements to consider when creating a cashier’s balance sheet:

1) Total assets – This includes all the cash, checkable deposits, and other liquid assets held by the business. Make sure to list each item’s value and how long it has been owned by the business.

2) Total liabilities – This includes all the debt obligations of the business, such as loans and credit card balances.

3) Net worth – This is simply subtracting total liabilities from total assets. A positive net worth indicates that the business has more money available to spend than it owes others.

4) Name and Address of Business – This should be the first column in your spreadsheet, and should include the company’s name and address.

5) Current Ratio – Calculate the current ratio by dividing a company’s net worth by its liabilities. A ratio of 2 or less is generally considered to be a healthy financial situation for most companies.

Why is Creating an Effective Cashier Balance Sheet Template Important

Creating an effective cashier balance sheet template is important for several reasons.

- First, it can help managers and owners understand the financial health of the store.

- Second, it can be used to evaluate employee performance.

- Finally, a good balance sheet can provide valuable insights into the overall business strategy.

There are many factors that go into creating an effective cashier balance sheet template. The most important aspect is ensuring that all data is accurate and up-to-date.

Additionally, it is important to keep track of any changes in credit card processing or inventory levels. Finally, it is helpful to include benchmarks for comparison purposes.

By using an effective cashier balance sheet template, managers and owners can better manage their businesses and improve employee productivity. A cashier balance sheet template is a handy tool that can help businesses analyze their financial performance.

How to Create a Cashier Balance Sheet Template

Cashier balance sheets are a great way to help your business stay organized and track its cash flow. By creating a template, you can easily create accurate reports and ensure that all transactions are accounted for. Here is one of the ways of creating an effective cashier balance sheet template:

1. Start by gathering all of the necessary data – This includes your company’s name, address, phone number, and financial information. You will also need the names and addresses of your employees and their corresponding salaries.

2. Create columns for each category of information – This will make it easier to track your company’s finances. For example, you could create columns for income (e.g., sales receipts), expenses (e.g., rent payments), assets (e.g., cash on hand), and liabilities (e.g., credit card debt).

3. Print out the template and fill it in – Once you are done, you will have a complete cashier balance sheet.

To create an effective cashier balance sheet template excel, begin by gathering all relevant data. This includes information such as total deposits and withdrawals, as well as the current account balance.

To calculate the net worth, subtract outstanding liabilities from total assets. Finally, divide this figure by the number of days in the fiscal month to create a daily average. Once the data is gathered, it can be organized into categories using headings such as “Inventory,” “Cash,” and “Net Worth.

Tips and Advice on How to Create an Effective Cashier Balance Sheet Template

Effective cashier balance sheets help businesses understand and manage their cash flow. They can also provide valuable information about customer spending, inventory levels, and other financial data.

A well-designed balance sheet should be simple to understand, easy to update, and accurate. Here are a few tips for creating an effective cashier balance sheet template excel:

1. Start with a clear goal – The first step in creating an effective cashier balance sheet is determining your goals. What do you want to learn from the data? What do you want to improve? Once you have your goals in mind, start designing the template based on those objectives.

2. Make it simple – As with all financial documents, a good cashier balance sheet should be easy to read and understand. Use clear font formatting, bulleted lists, and tabular data to make information easy to digest.

3. Use a professional template – You can use any spreadsheet or accounting software to create your cashier balance sheet, but it is important to keep the format easy to read and follow.

4. Add your logo, contact information and website URL.

5. The cashier balance sheet is a very important document that should be well organized, easy to read and understand, and professional in appearance. Cashier balance sheets are used to show the different sources and uses of cash for your business, and you will find that it is a very important document to keep at all times.

Summary

Creating an effective cashier balance sheet template excel is essential for any small business. By keeping track of total cash and inventory, a business can better manage its finances and keep tabs on its overall trend.

Additionally, knowing how much money is available at any given time allows the business to make informed decisions about where to allocate resources.